Central banks are focusing on defeating persistently above-target inflation, by performing the most aggressive tightening in 4 decades:

- FED 500 bps since March 2022 (5% in 14 months)

- BOE 440 bps since December 2021

- ECB 375 bps since July 2022

This tightening ended global bull market of 2021 and slashed valuations and pierced bubbles in the most speculative markets. In 2023 markets recouped some of the 2022 losses. Tape remains fragile and consensus is that hikes have a delayed impact on the economy and will eventually bring recession. Any monetary policy choice from now on has an increased risks:

- Cut – rekindle risk taking behavior in already bullish and richly priced equity markets. Although economy is slowing there is still persistent strength in the economy and corporate profits which leads many to believe that we could still have a soft landing. Cuts would help to reduce risk related to duration mismatch of assets and liabilities on balance sheets of various financial intermediaries. This in turns offers indirect support for banks and a number of over-indebted companies.

- Pause – breathing space for credit market and the economy that allow to incorporate impact of previous hikes. Also it is perhaps the safest path to the soft landing.

- Continued tightening – will decelerate growth further in already slowing economies and may create more pressure in credit markets, making whole financial system vulnerable to shocks. Increased pressure on credit markets and potential for prolonged stretch of bankruptcies amongst the zobie companies, which number increased by over 10% since pandemic, to 5.7% in the US and 4.7% globally. If rates will keep on raising further we could see a double digit growth in number of zombie companies (Financier worldwide, Feb 2023).

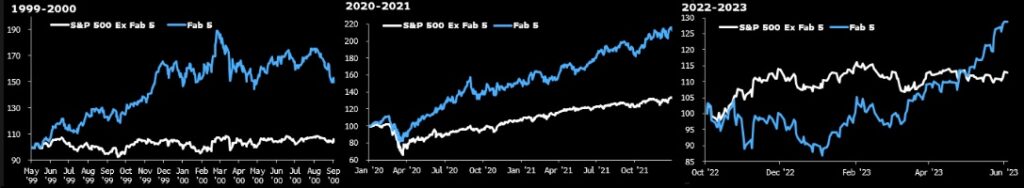

Despite difficult macro environment, Nasdaq composite gained 26% this year, with nearly all gains driven by few tech stocks which are either recovering last year’s steep losses (e.g. Facebook) or are winners of AI revolution (e.g. Microsoft, Nvidia).

Those big tech stocks naturally drive indexes due to their size (7 biggest tech stocks represents $10t market cap and over 25% of S&P 500 index value), but also due to their unique product lines that help to rekindle economic growth. It also happen that these are the same big tech names kicked-off mid-to-late 2020 recovery (and later on bull-run). Back then mega-cap flourished in the pandemic due to accelerated digitization of the global economy. Now they flourish in expectations of increased revenues driven by their ability to syndicate, a developing, capex hungry AI ecosystem. In addition their cost-cutting exercise already brought enhance profitability and improvement to the operational efficiency. In addition they provide investors more reassurance in turbulent times, due to their moats, and monopoly-like power which immunizes them from competitive or consumer pressure.

Those few big-tech names are the leaders of the market recovery. In order to for the rally to transition into new bull market, we need to see broadening beyond the tech.