The United Kingdom is still home to one of the most important capital markets in the world (although in terms of market capitalization UK was overtaken by Japan, China, Hong Kong over the last decade). Its popular market index FTSE 100 and FTSE 250 are still relevant not only to the UK and European but also to US and Global Investors who want to gain diversified international exposure.

Despite its importance, the UK indexes have been underperforming over the last decade. Currently trading at close to 30% valuation discount to its global peers, which is close to 30-year lows. Over the same period, the US market had a marvelous run and more than quintuple since the bottom of the financial crash in March 2009.

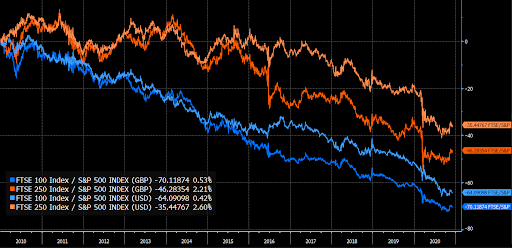

Charting relative performance of the representative indexes for both markets (S&P 500 vs FTSE100/FTSE250) is painting a staggering picture. Investors in the UK have lost between 35% and 70% of the performance vs investments the US, depending on currencies they’ve invested (GBP vs USD).

Source: Bloomberg

Identifying the cause of this hefty underperformance is critical to understanding our investment and can help us to make informed allocation in the future.

In this article I will try to explain key factors that caused this relative performance gap between those two key global markets. These factors remain relevant, and will have an impact on performance in the near future. To make analysis coherent and concise I have focused on 2 representative benchmarks:

- S&P 500 – The most widely-used benchmark for measuring the performance of large capitalisation, US-based stocks.

- FTSE 100 – Gauge of prosperity for businesses regulated by UK company law. Top 100 companies on the London Stock Exchange by market cap.

Sector Exposure

The UK market is trailing other global indexes, mostly due to its structure – exposure to oil, mining and banking. All those sectors have been under pressure from the lower oil and commodities prices or lower interest rates. Analysts of those sectors also expect relatively little from their near-term future earnings. Also its exposure to the technology stocks is almost non-existent.

In addition, they’ve been under pressure of transition to sustainable investing. In some cases, companies in those sectors started being underweight or excluded from the portfolios due to low scores in terms of environmental, social and governance (ESG) factors.

In comparison, the US market is heavily weighted in tech companies (over a fifth), which led the global economic growth over the last decade. They also don’t face the same ESG pressure.

Polarising impact of Pandemic

The Coronavirus and the resulting lockdowns and restrictions are severely testing the economic resilience of each market. Pandemic has simultaneously disrupted both supply and demand in an interconnected, globalized world. The path, duration, magnitude, and impact of the pandemic is uncertain. Even with all of those risks one sector not only withstands the economic pressures caused by pandemic but also provides the growth opportunity – US tech. Even now after the coronavirus pandemic hit the world, US tech giants are driving strong rebound in the global equities. Due to accelerated need for digitization caused by the pandemic, US tech is uniquely positioned as an enabler of this technological change. Those tech companies constitute a large portion of the US indexes, making the overall market more attractive. The same forces on the other hand have negative impacts on the revenues of most companies traded in the UK leading to underperformance relative to the US.

A global rotation into value after positive vaccine moves can breach the gap, and result in the near-term outperformance of FTSE 100 vs S&P 500 which valuations are currently stretched. The question is how much of the expected vaccine-triggered rotation is already priced in?

Value vs Growth

“Value” has underperformed “growth” or “momentum” styles for over two decades. The relative valuation gap between growth and value is near the record level at 25-year high (read more here). FTSE 100 has a strong characteristics of a value index – lower multiples, higher book value, higher yield. For this reason it attracts the same sentiment as other value indexes which deflates its performance relative to more momentum driven, growth indexes. This is the explanation why FTSE 100 underperformed more growth oriented S&P 500, which links to the next section – mature vs developing companies.

Mature vs Developing

When the FTSE 100 launched in 1984, it was mostly made up of businesses serving british customers. It changed drastically since then, with only 28 out of the original 100 companies still in the index. In the last decade however, sector exposure has been quite stable. Now FTSE 100 is full of mature, cyclical companies which have lower revenues and earnings growth rates. They also face competitive, technological and regulatory challenges.

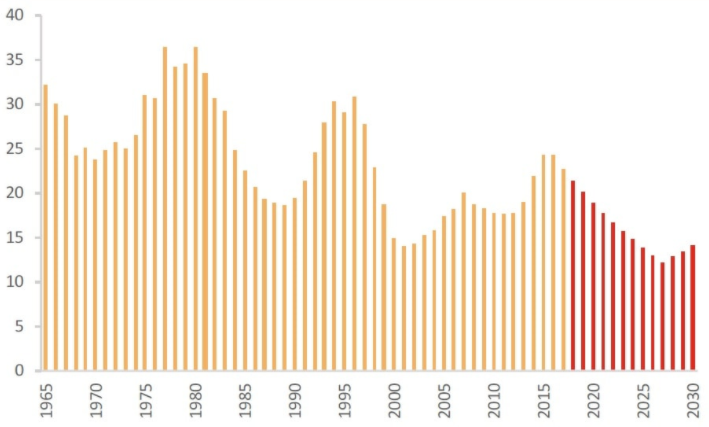

The S&P 500 Index, first compiled in March, 1957, but the lifespan of large, successful companies has never been shorter. A recent study by McKinsey found back then the average lifespan of a company in S&P 500 was 61 years, by 1965 it was 33 years, and by 1990 only 20 years. Today, it is less than 18 years and is forecasted to shrink to just 12 years by 2027 (Anthony, Viguerie, Schwartz 2018). McKinsey believes that, in 2027, 75% of the companies currently quoted on the S&P 500 will have disappeared (by being merged, bought-out or going bankrupt).

The average lifespan of the companies in the index fluctuates in cycles. Those cycles mirror the overall state of the economy and reflect disruption from economic shocks and new technologies. This effect is presented on the chart below which shows average lifespan of the company in S&P 500.

Source: Anthony, Viguerie, Schwartz 2018 [2].

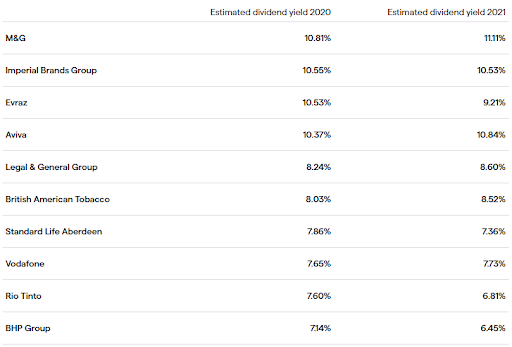

Yield

CFOs of UK listed companies are aware that their company’s relative valuation is perhaps underestimated. Many of them recently initiated, or extended share buyback programmes. UK dividend payout is also reaching the new highs with the top 15 companies responsible for nearly a 60% of the payout. Higher yield usually signals that managers of a company see less opportunities to deploy capital within the company, and invest in projects at an attractive rate that adds shareholder value. In such a situation returning money to investors is a better choice. In comparison S&P 500 has a lower yield, which can signal that on average, there are more attractive opportunities in front of the managers of the US listed companies (on the contrary one can argue that low yield is caused by high current valuations). FTSE 100 dividend yield is currently over 4%, in comparison SP500 yields only 2%.

Brexit

With additional uncertainty after the Brexit referendum in June 2016, attitude towards investment in the U.K. is lacklustre. Over 4 years later, the Brexit issue is still not resolved, which makes the UK business environment more complicated. This is an important reason why global fund managers allocate less capital to the UK market (underweight) over the last four years (according to Bank of America Merrill Lynch’s global fund manager survey).

A lot of this is related to negative sentiment and additional complexity, rather than the actual negative impact of Brexit on the company’s revenues. In fact, over the years FTSE 100 has become less UK-centric index and instead more closely reflecting the fortunes of the global economy. Currently more than two-thirds of UK equity market revenues are derived from overseas. Most of their earnings are in US dollars, thus weak dollar or strong sterling reduces the FTSE 100’s sterling earnings. Exchange rate has been advantageous in recent years as the GBP rate has never recovered after the Brexit referendum. For most of this period trading at a 10% to 18% discount compared to pre-referendum level. It’s been very volatile as well, which brings another uncertainty to manage and increases requirements to hedge the currency exposure.

Summary

There is a significant valuation divergence between the main UK and US indexes. Most of it can be explained by the factors described above. I believe that those factors will remain relevant in the near-term future as they were in the last couple of years. Therefore it is critical to spend time on fully understanding those factors when allocating capital between the US and UK market.

Choosing between two indexes is a bit like choosing between growth and value portfolio. The UK market recently has been problematic, but a widespread negative sentiment towards the UK can provide an opportunity for patient value investors.

References:

- Jeremy J. Siegel. Jeremy D. Schwartz. “The Long-term Returns on the Original S&P 500 Firms” Dec 2004 link

- Scott D. Anthony, S. Patrick Viguerie, Evan I. Schwartz and John Van Landeghem. “2018 Corporate Longevity Forecast: Creative Destruction is Accelerating” Feb 2018 link

- Anzél Killian. “Highest-yielding dividend stocks to watch in the UK”, Jul 2020. link