While the rule of thumb indicates recession as two consecutive quarters of falling real GDP, many institutions look also into other variables to confirm economic downturn. This usually includes consumer and business spending, industrial production and labour market. Current situation is widely recognized by experts as a ‘technical recession’ that is likely to turn into a real recession event over the next few months. Here are few key reasons this may occur:

Preceding Economic Overheating Conditions

Economists agree that overheating suggests a very high probability of recession (Alex Domash, Lawrence H. Summers, 13 April 2022 link). There are many indicators, but historically just these three predicted most severe of the past 77 recessions in advanced economies since 1961 (Goldman Sachs Research, 05 JUL 2022, link):

- High labour cost growth

- High core inflation

- Cumulative increase in policy rate

Based on data all three conditions have been met. First of all, the US non-farm unit labour costs jumped an annualised 12.6% in Q1 (4.4% wage increase and 7.3% decrease in productivity), after an increase in nominal wages by 4% in 2021 (largest increase in 20 years, Source: Reuters 2022/01/28 lnk).

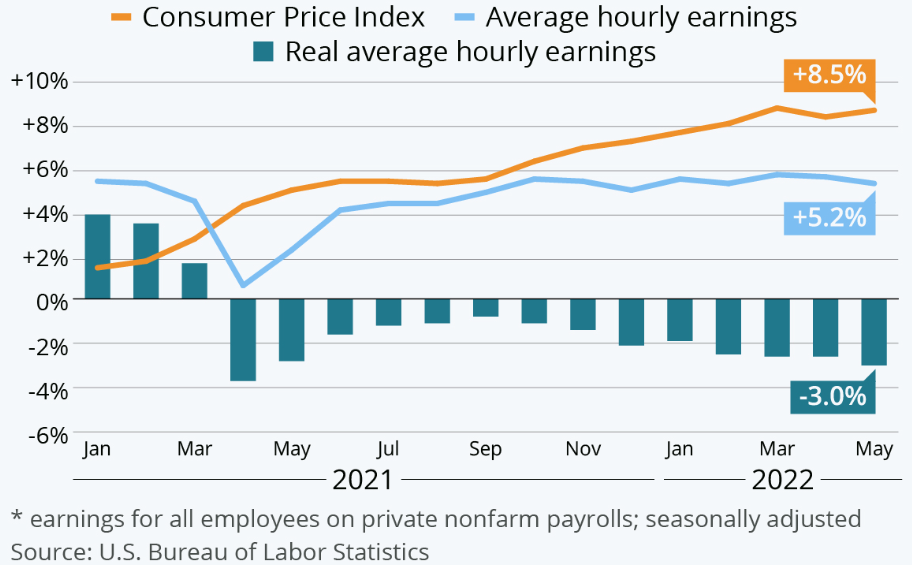

Year-over year change in real and nominal earnings and the Consumer Price Index (CPI-U) in the US

Source: US Bhttps://karolpelc.com/blog/wp-content/uploads/2022/08/image2.pngureau of Labour Statistics, statista (2022.06 link)

At the same time at the start of the year, the US had the highest number of job openings in recent history, which only started to decrease in Q2. Secondly inflation increased to the highest level in 40 years, and was higher than the wage growth.

Job openings rate, seasonally adjusted

Source: Job Opening and Labour Turnover Survey (May 2022, bls.gov)

And finally we know that the FED has planned a series of rate hikes in order to combat inflation. FED plan is difficult to exercise for three main reasons:

- Historically engineering a soft landing is very rare, especially when hiking rates into the slowing economy.

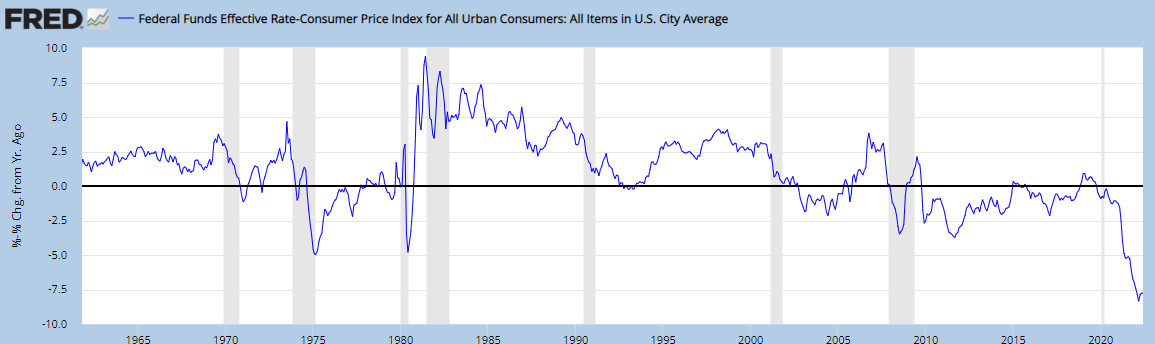

- FED started increasing rates very late, which is reflected in the widest gap between Federal Funds Effective Rate and the CPI on record.

Federal Funds Effective Rate minus the Consumer Price Index (11/1961 – 07/2022)

Source: FRED (link)

- Big part of the problem with Inflation is related to the factors that FED cannot influence through interest rate increase. These are global supply chain issues and geopolitical tensions (Russia-Ukraine war).

Decelerating Economic Growth

Economic slowdown is the biggest worry for investors. Damage caused by pandemic and Russian invasion of Ukraine were cited as two main causes of decelerating growth by the world bank (7th of June 2022, link). Global growth forecast for this year was cut from 4.1% expected in January to 2.9%. Both events will contribute to per capita income in the developing economies to be 5% below the pre-pandemic trend.

Contraction in Euro-area economic activity

Source: Bloomberg

PMI across the globe are also declining. The Flash US PMI Composite Output Index had a sharpest decline in July, since the initial stages of pandemic (or excluding pandemic, since GFC) and service PMI are also in contraction territory. This means some of the sectors are already in contraction.

S&P Global Flash US PMI Composite Output Index

Source: pmi.spglobal.com

Continued Weakness in Commodity Markets

Weakness in commodities continuing to the month-end with everything from oil and nat-gas to agricultural products and metals declining in June. Most importantly industrial metals are in decline. This includes copper which, thanks to its widespread application, has a good record of predicting the turning points in the economy (hence analysts often call it “Dr Copper”, “Ph.D. in economics”).

Weakness in Commodity Markets

Source: topdowncharts.com

Inventory build up

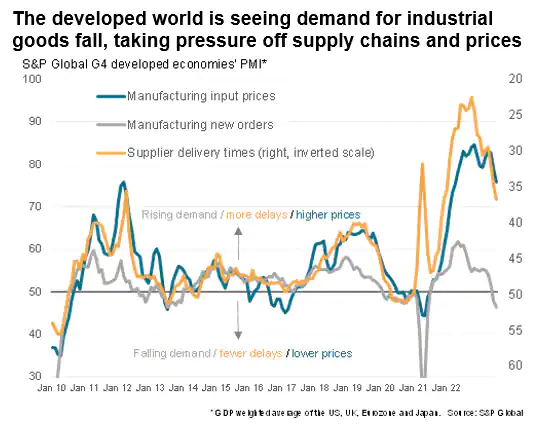

While we see release of some supply chain pressures, unfortunately they can be explained by decreased demand for the production inputs. This is due to the build up of the inventories in the factories. The same can be seen at retailers. Two examples:

- Walmart cut Q2 guideline as it sees decreasing demand as consumer shifts in spending from goods to services leading to inventory buildup.

- Target issues warning that it holding too much inventory

- Boohoo operating in the fast-fashion sector, and Frasers which sells past-season clothes, both reported inventory built up. This is important as the fashion industry cannot hold inventory for long periods.

Fall in demand for the Industrial Goods

Source: IHS Markig (Williamson, Biswas, Patel, 25 July 2022 link )