Inflation is cooling, due to restrictive monetary policy that is starting to impact the aggregated demand.

Main tool used by the central bank to reduce aggregated demand is interest rates increases. Higher rates are helping to reduce consumption through making savings relatively more appealing, and helping to reduce business investments and export through increase in financing costs. Furthermore two factors are negatively impacting employment, which further reduces aggregate consumer spending and reduce price pressures.

AD = C + I + G + ( X – M )

where:

AD = aggregate demand

C = consumption

I = investment

G = government spending

X = total exports

M = total imports

However there is also a supply side of an inflationary equation, which recently do not get enough attention. There are growing supply side pressures linked to the ‘structural shifts in the global economy’ (to use this year’s Jackson Hall, global economic symposium’s title), which will affect inflation over the multi-year horizon. I want to focus on three such shifts, which I consider most important in determining the long-term global inflation picture. All three are affecting supply side of the inflationary equation, but what’s most interesting is that for last few decades they had a deflationary impact and only recently started to turn inflationary.

These are the three major structural shifts which may cause a long-term inflationary pressures.

End of cheap Labor

In last few decades we had an era of globalization with outsourcing of the production to the emerging economies. Most notable cause of deflationary pressures experienced over the past 35 years was access to significant pool of cheap labor from China which lacked pricing power. Over recent decades China build up capital, shift to more capital-intensive production, increased labor productivity as their labor became more educated and specialized (Butollo, 2014). This in turn increased their bargaining power on the global stage. The wage gap between American workers and Chinese workers has fallen from 34.6 times in 2000 to just 5.1 times in 2018 .

Last year Chinese society shrunk in the population for the first time in 60 years.

Source: Reuters, ‘China’s first population drop in six decades sounds alarm on demographic crisis’, Zhang, Master (link)

Chinese demographic development, causing an imminent transition to a labor-short economy. Aging and declining fertility result in smaller working-age population, which peaked at 801 millions people in 2015 (National Bureau of Statistics of China).

Social changes discovered in recent surveys reflects that negative demographic changes may accelerate further. Over last few decades China has also shifted household structure from 4.4 to 2.6 persons per household. This has been mostly driven by 35-years of restrictive policies limiting families to one child. Policy was lifted on January 1st 2016, and since Chinese government shifted its focus to increase fertility.

Chinese government have announced policies to encourage families to raise more children, but so far results have been mixed. According to last year’s survey (Source: Guardian 20/01/2023), over half of young adults in china indicated that they don’t want to have children. Out of couples married last year 40% not intend to have a children. Also 40% of the babies born in China last year, where child of couples who already had one. Furthermore 2/3rd of young woman consider marriage unnecessary, and only 1/3rd wish to have children. Since 2004 number of single person household has been raising in China, and it’s now surpassing 25%.

Majority of papers attempting to explain decreasing birth rate points to changes in lifestyle. They point out that Chinese youth have more difficult tasks to raise family in a modern congested urban centers of China, than their parents generation. Difficulty comes from limited living space, lack of daycare support offered by traditional multi-generational households, and a longer commute times. Also the most successful individuals, with ample resources to raise family, are often working in competitive environment, entrenched in the grueling 9-6-6 work culture (9am to 6pm, 6 days work week). These social changes can lead to a highly individualized society with increasing sense of social alienation, decrease acceptance of social values and inadequate fulfilment of the social obligations.

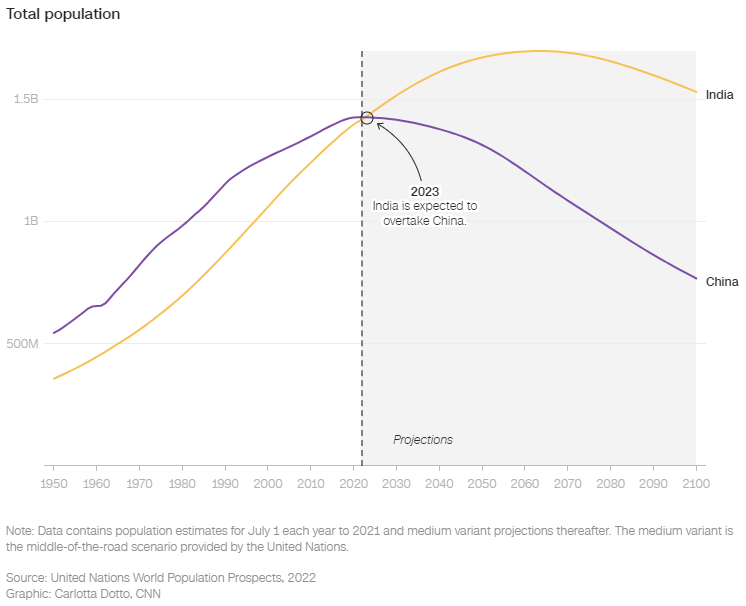

Reduction in access to Chinese labor is partially offset by India, which is now he world’s largest contributor to the global working-age population growth. India is expected to surpass China’s population this year.

Source: CNN, ‘How India’s population exploded to overtake China’s and what’s next’, Dott, Mogul, 09//07/2023 (link).

Problem is that India struggles to attract global investments fast enough to create enough well-paying jobs for the 5 millions people who enter its workforce every year. Unless India modernize quickly it could turn it’s demographic dividend into an unemployment nightmare. Meanwhile over the last decade investment growth in India halved from 10.5% to 5.7% per year (Source: World Bank).

End of cheap Energy

Energy sector, especially in oil and gas went through a decade of under-investment, leading to reduction in production. Hopes for quick adoption of renewable technologies where heavily flawed. Countries realizing that transition will now take longer than expected, based on the earlier estimated of adoption curve.

European countries, including Germany are bringing coal-fired generation online to prevent from full-fledged energy crisis. They are also more open-minded about restarting local mining and drilling.

Piling climate pressures and rise of ESG is marking end of an era of cheap energy.

—— PENDING ——

End of cheap Production

Persistent supply chain disruptions, worsening political tensions and growing demand for securing intellectual property in the age of AI are accelerating manufacturing reshoring. Businesses are moving away from Just-In-Time supply chain, and are willing to offer a premium to ensure reliability of supply. With all the onshoring production costs will inevitably increase.

—— PENDING ——