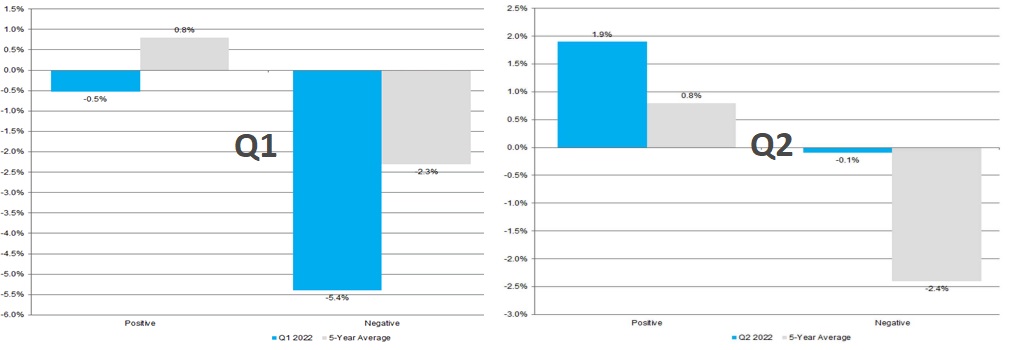

End of 2021 marks the peak of the raging bull market supported by a fast recovering economy and record fiscal and monetary stimulus. At that time, the risk of inflation and overheating of the economy were discussed by everyone. Valuations were on the peak and therefore any disappointments were severely punished by the market (the most in recent history). In Q1 the market was unforgiving for missing earnings.

In contrast in Q2 – earnings misses are not punished at all. This is because sentiment has already become bearish. Early in the year market has significantly declined and valuations have shrunken. This decline was mostly caused by the macro concerns, and partially to reflect expectations that the next quarter earnings might disappoint. By now most investors have already acted on the bearish outlook – those those who wanted to sell have already sold. Therefore the appetite for selling has significantly decreased, so has the investor’s sensitivity to the negative news. Therefore in Q2 there was no significant price change for the companies who’s earnings announcement where interpreted as worse than expected.

S&P Earnings Surprise vs Average Price Change

Source: Factset Earnings Insights (5th of August 2022, link)

Extreme reaction to earnings miss in Q1

Source: FT, ‘US companies endure record knock for missing earnings forecasts’ (link)

Bearish sentiment and the market bottom

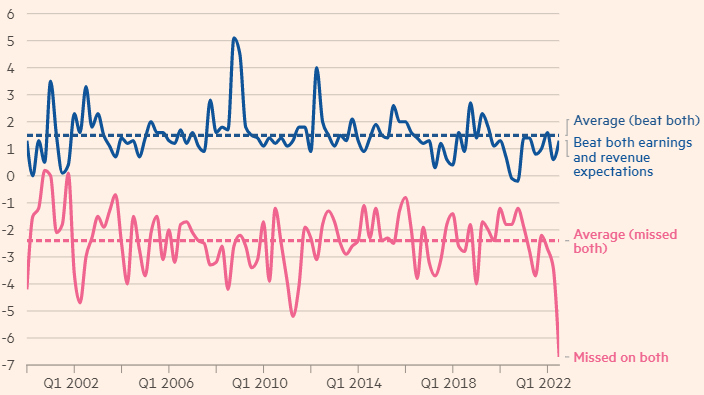

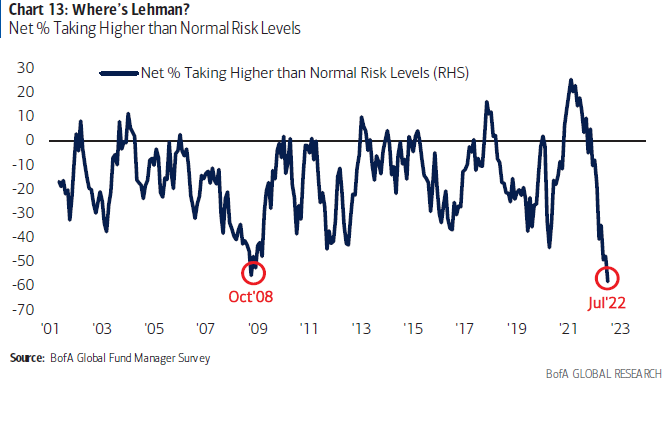

During the last six months, valuations and earnings expectations have deflated and companies issue earning warnings, causing investors to brace for further decline and turn sentiment shifted extremely bearish. Aldough valuations are now much more attractive and sentiment points to oversold conditions, that’s not always enough to call a bottom. This is because the sentiment bottom is never perfectly aligned with the price bottom (although they are close). Example is GFC (The Global Financial Crisis 2007-2008), where after initial rapid sell-off, sentiment hit bearish extreme in October 2008, but market drifted in apathy lower for the next few months until they bottomed in March 2009. This is what Bank of America argues in their most recent monthly Fund Manager Survey. In their report we can see that investor capitulation.as they decrease exposure to risk assets most since GFC.

Percent of Fund Managers, taking higher than normal risk

Source: BoA, Global Fund Manager Survey (July 2022)

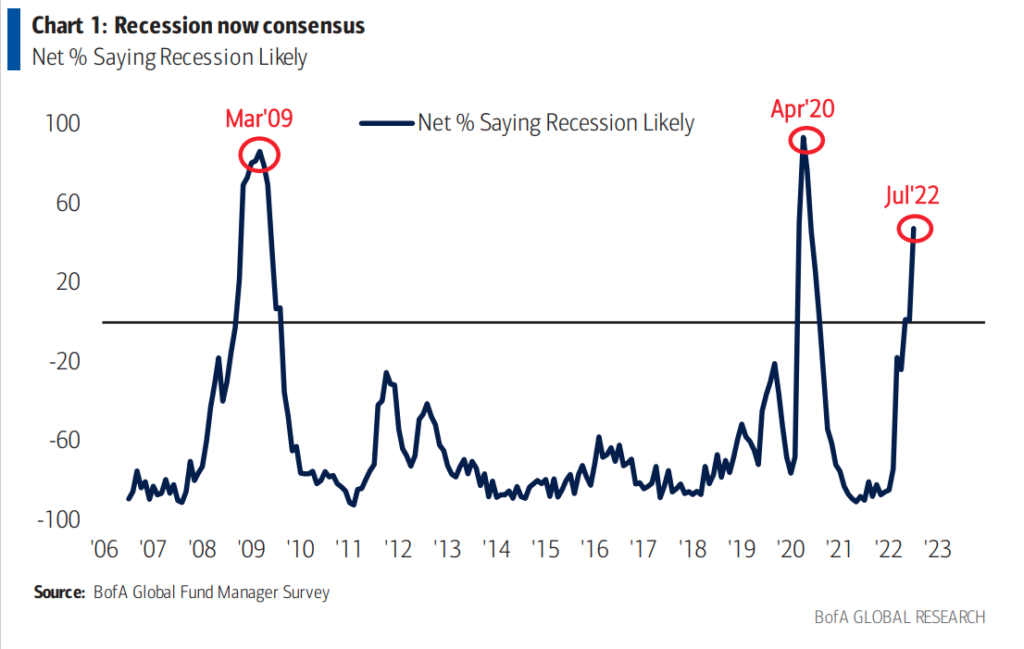

At the same time the report reflects that investors are most bearish on equities and most bullish on cash. What is even more interesting is that portfolio managers have a near consensus view that we are in a recession – a signal which marked the market bottom during the GFC.

Recession expectation amongst Fund Managers

Source: BoA, Global Fund Manager Survey (July 2022)

It is also worth referring to a sentiment survey done by the American Association of Individual Investors, which gives insights on investors sentiment by asking them where the market is heading in the next six months. In the last two weeks, their indicator is recovering from an extreme reading of bearishness. Most recent peak was on 22nd of June, when 59.3%of surveyed investors expected the market to be lower six months from now.

What’s next?

Investors are currently extremely bearish, underexposed to the risky assets compare to the historical average and have a modest to no reaction to the negative news. This means that sell-off has faded, market bears finished their lunch, and bulls are getting impatient for their turn. At the same time I expect that bear market will continue for sometime. We would still need to see a significant reduction in the CPI print, increased geopolitical stability and change to the monetary policy, before calling the end of the bear market; but we are poised for at least a strong bear market rally.